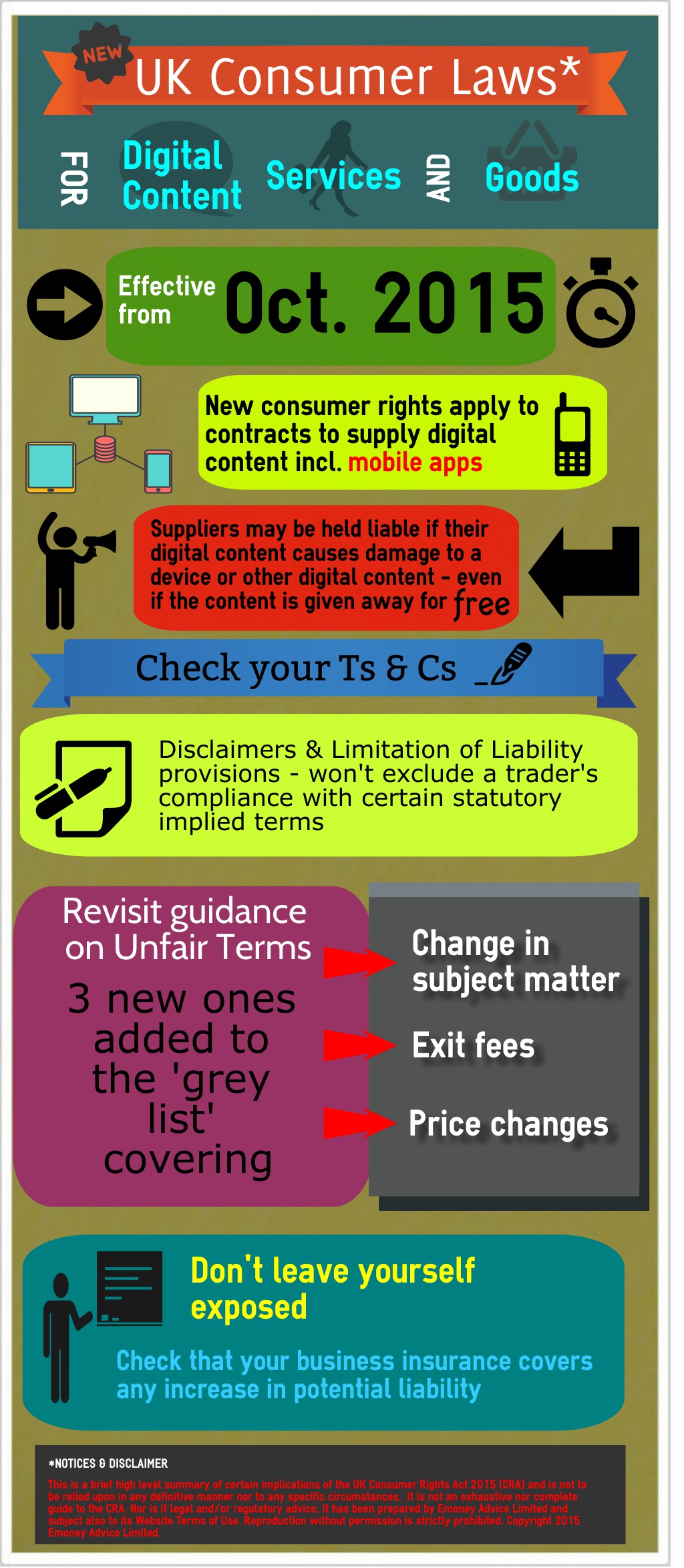

A significant reform of UK consumer protection law has been carried out with the enactment of the Consumer Rights Act 2015 (“CRA”). Many of the key requirements of the CRA will come into force from October this year.

The CRA will both supplement and consolidate existing UK consumer law, with some of its key features including:

- New rules expressly applicable to “Digital Content“ – this will include mobile apps. these new laws may increase legal exposure. For example, even if a trader provides digital content (such as an app) to consumers under contract for free – they can still be held liable under certain circumstances if the digital content causes damage to any device or other digital content

- Wider implied terms – the CRA gives contractual status to certain information provided by a trader

- Implied terms will not fall within exclusion clauses – the CRA expressly prohibits a trader from excluding liability for certain implied terms, and

- Consolidating consumer ‘unfair terms’ – with 3 new ‘grey list’ terms being added.

How should e-money / payment services businesses prepare for the CRA?

Some of the key areas to be considered in anticipation of the CRA include:

- Review your product and service offering – note which parts of your offering involves the provision of digital content, services and goods (if applicable) to determine which new rules apply in each circumstance.

- Review your consumer terms and conditions – with particular care to review:

- any disclaimers, exclusions and/or other limitation of liability provisions

- the use of plain language

- the placement of key terms such as price and the subject matter

- whether you can split out obligations under your terms between customers that do and don’t fall under the new statutory definition of consumer, and

- compliance with the revised list and guidance on unfair terms.

- Review any website / promotional / general information provided to consumers – as noted above, these could form part of the consumer contract as implied terms.

- Review insurance arrangements – to ensure that any increases in liability are covered by general business insurance.