One of the significant changes proposed by PSD2 is the right of Third Party Payment Providers (TPPs) to be granted access rights to account servicing PSPs. Vocalink, together with Equens SE and Nets have issued a white paper suggesting a framework for how such access may be realistically granted.

What is meant by PSD2 Access Rights?

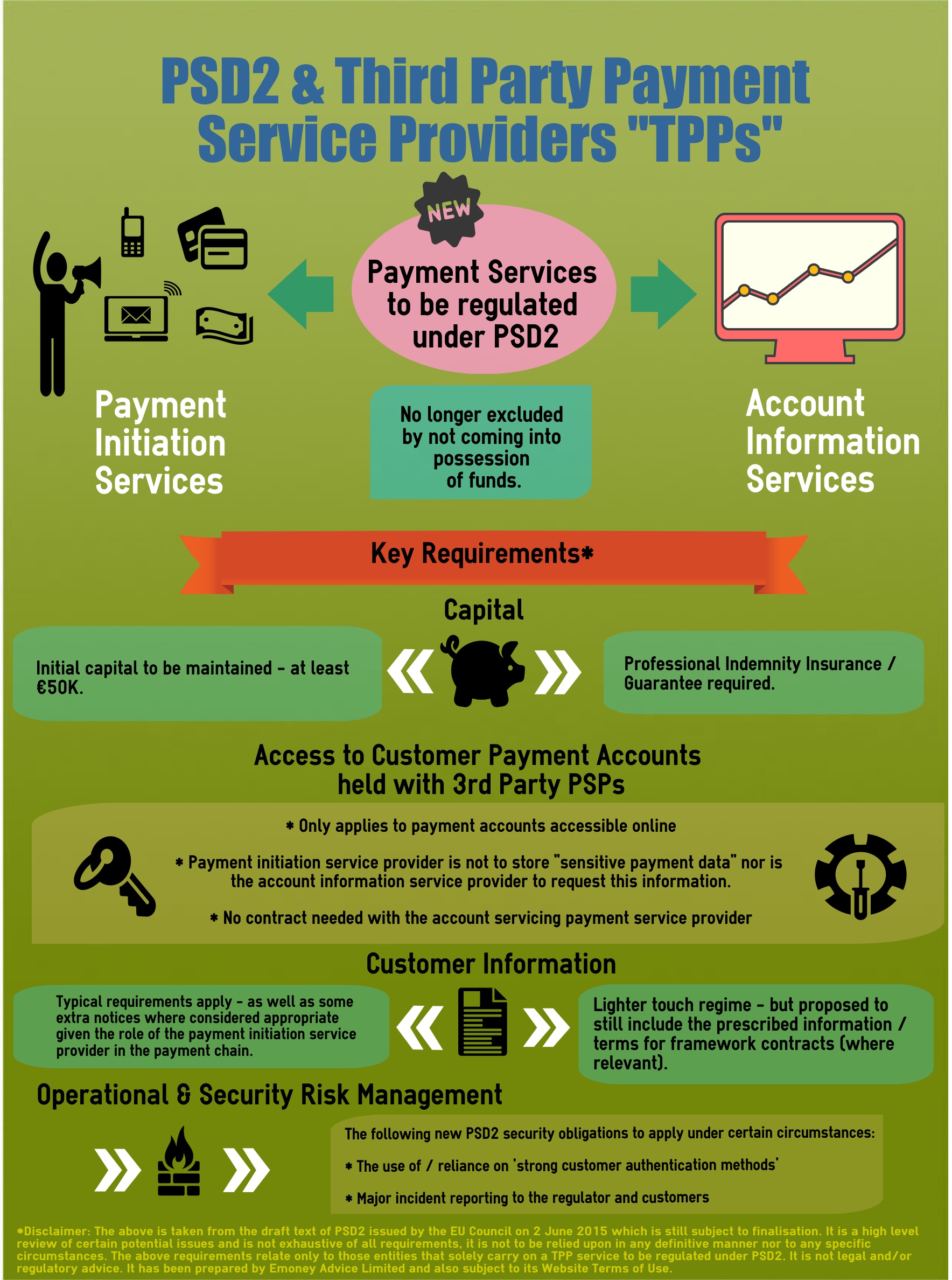

PSD2 will permit the newly regulated categories of payment service providers that offer: “Payment Initiation Services” and “Account Information Services” certain rights of access to, and the use of information on, the availability of funds on a payment service user account held with another payment service provider. Such access rights are a real step change in how PSPs are required to interact with each other and offer a clear regulatory advantage to TPPs over existing players. Further details on the rule can be accessed here.

What is proposed by the PSD2 Access Rights White Paper?

Using an open, optional ‘Controlled Access to Payment Services’ (CAPS) methodology, it is proposed that a new service be offered with the following three layers:

1. PSD2 Compliance Layer

This provides a ‘basic’ technical centralised solution allowing a TPP to connect with an account servicing PSP. Its key advantage is that it should remove the need for the TPP to integrate multiple connections.

2. CAPS Framework layer

This layer builds on the above and will provide additional functionality. It is proposed to cover such matters as governance, authentication and liability frameworks.

3. CAPS Plus layer

This layer offers additional services not necessarily required by the TPP access rules, including such matters as age and address verification.

Comments

- It is encouraging that the industry is already looking for technical solutions to some of the new proposals set out in PSD2, even before the EBA has issued any formal technical standards.

- The white paper identifies some of the key challenges of the new PSD2 TPP access rules – namely that there is no requirement for the TPP and the account servicing PSP to have a contract in place, even though there are liability issues to be allocated between them. The CAPS framework looks to address some of the dispute resolution issues which will undoubtedly arise.

- Stakeholders in this area should review the white paper and start thinking about how they will look to comply with the rules – now is the best time to get in front of the new requirements and help shape their implementation.