(Note: the below is a high level review of certain potential issues and is not to be relied upon in any definitive manner nor as legal and/or regulatory advice).

What is the EC MIF Regulation?

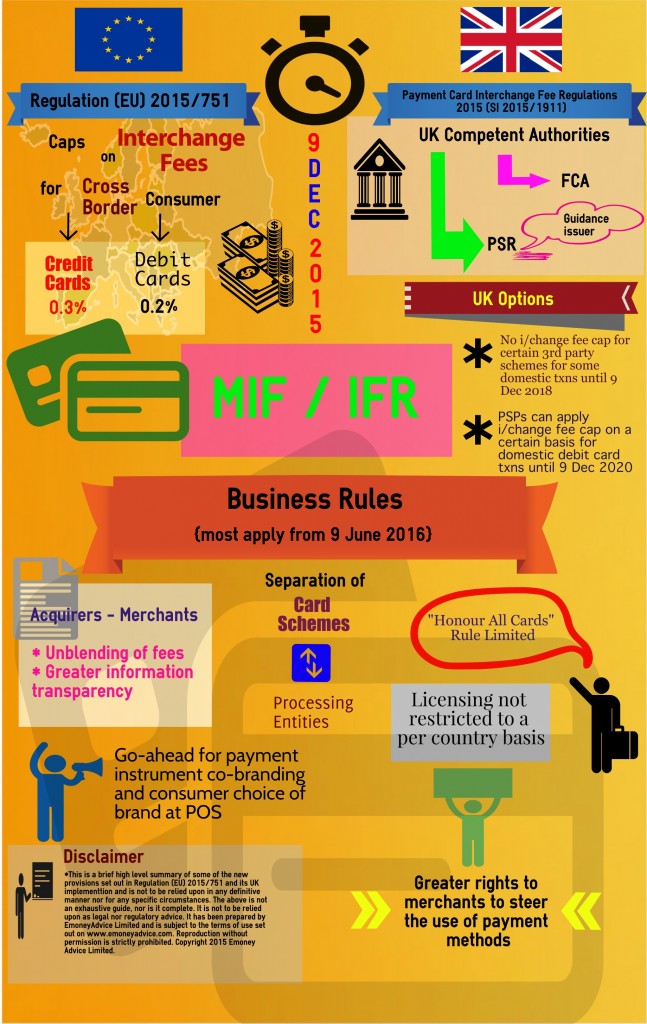

The EC MIF Regulation (also called the Interchange Fee Regulation / IFR) refers to the regulation of the European Parliament and of the Council on multilateral interchange fees (MIFs) for card-based payment transactions. MIFs are inter-bank fees typically agreed on a collective basis between the acquirers and issuers of a particular card scheme. The EC MIF Regulation regulates interchange fees across the EU in addition to the competition investigations and binding commitments of certain card scheme operators. The EC MIF Regulation is accompanied by the Payment Card Interchange Fee Regulation 2015 (SI 2015/1911) which appoints both the UK FCA and the PSR as the UK competent authorities. It also implements in the UK the options made available to Member States under the EC MIF Regulation. The UK IFR becomes effective on and from 9 December 2015.

One of the key reasons given for the EC MIF Regulation is due to the fact that:

“there are a variety of interchange fees applied within national and international payment card schemes, which gives rise to market fragmentation and prevents retailers and consumers from enjoying the benefits of an internal market for goods and services.”

What is its status?

The EC MIF Regulation was published in the Official Journal on 19 May 2015. It’s provisions become operable on different dates. The Interchange Fee Caps will take effect on 9 December 2015, with most of the business rules provisions taking effect from 9 June 2016. As mentioned, above, the UK IFR comes into force on 9 December 2015.

High level summary of its key requirements

Interchange Fees for Cross Border consumer debit & credit card transactions

Debit card payments

Payment service providers will be prohibited from charging a per transaction fee for cross border debit card transactions (or a fee with a similar object or effect) in excess of 0.2% of the value of the payment transaction. It is proposed that this fee should apply to all debit card transactions (cross border and domestic) following 2 years after the regulation is implemented.

Credit card payments

Payment service providers will be prohibited from charging a per transaction fee for cross border credit card transactions (or a fee with a similar object or effect) in excess of 0.3% of the value of the payment transaction. It is proposed that this fee should apply to all credit card transactions (cross border and domestic) following 2 years after the regulation is implemented.

Licensing not restricted to a ‘per country’ basis

Licenses provided by the schemes for issuing and acquiring purposes are no longer to be restricted to a specific territory but are to be granted on an EU wide basis.

Separation of payment card schemes and processing entities

It is proposed that payment card schemes and processing entities shall be independent in terms of legal form, organisation and decision making. Further, they shall not discriminate in any way between their subsidiaries or shareholders on the one hand and users of these schemes and other contractual partners on the other. In addition, they shall not make the provision of any service they offer conditional in any way on the acceptance by their contractual party of any other service they offer. It is proposed that this should not apply to 3 party schemes.

Co-branding and consumer choice of payment card

Issuers are to be entitled to co-badge different card payment schemes on the one instrument. Also, where a payment device offers the choice between different brands of payment instruments, the brand applied to the payment transaction at issue shall be determined by the payer at the point of sale.

Unblending of fees (from acquirers to merchants)

Acquiring banks shall offer and charge payees (such as merchants) individually for different categories and different brands of payment cards and not impose a single ‘blended’ fee. Merchants can request in writing that their acquirer to charge a blended merchant service charge. Additionally, acquirers shall provide to merchants certain relevant information on the amounts applicable for the different categories and brands.

Limits to the ‘Honour all Cards’ rule

It is further proposed that payment schemes and payment service providers will be prohibited from requiring that a retailer accept a category or brand if they accept another category or brand, unless they are subject to the same regulated interchange fee.

Steering rules

Subject to the surcharging and similar rules under the PSD and other related legislation, payment schemes and payment service providers cannot stop retailers from steering consumers towards the use of specific payment instruments preferred by the merchant.

Payment information to be provided by the acquirer to the merchant

There are certain prescribed categories of information which the payment service provider shall provide to the merchant after the execution of a payment transaction, which may be adapted and provided in a certain prescribed manner.