(Note: the below is a high level review of certain potential issues and is not to be relied upon in any definitive manner nor as legal and/or regulatory advice).

The Fourth EU Money Laundering Directive (4MLD)

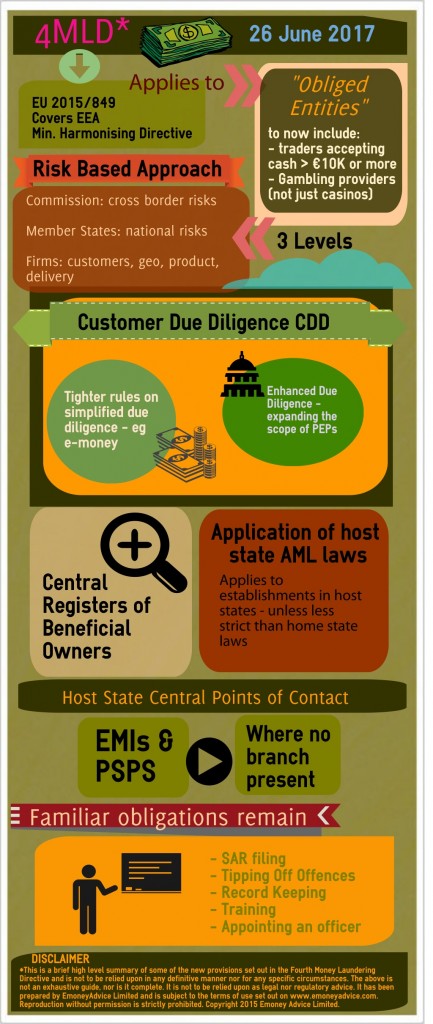

The European Parliament has now agreed on a new Anti Money Laundering Directive, which will supersede the current “3rd AML Directive”. It was published in the EU Official Journal on 5 June 2015 – indicating that its transposition into local Member State law should take place on or before 26 June 2017.

In the UK, 4MLD will be largely implemented by the Money Laundering Regulations 2017 – aided by the useful revised JMLSG Guidance.

Much has been debated over this instrument which has wide-spread implications to the compliance and business operations of both the financial industry – as well as those categorised in sectors where there is a risk of money laundering and terrorist financing (real estate agents, gambling service providers among others).

One of the widely reported changes is for greater transparency of the ownership structure of certain entities and in particular, the establishment of a central register of beneficial owners. As customer due diligence requirements already include obligations to identify such persons, this must be welcomed news to AML compliance departments to assist in their operational commitments – although the beneficial owners themselves may be less than pleased.

Key 4MLD Changes

1. Tax crimes

Tax crimes have been expressly included in the list of predicate offences linked to the definition of “criminal activity”. It is envisaged that this will assist in better co-ordination between AML/CTF and tax authorities – including where cross border co-operation is required.

2. Obliged Entities

The types of persons which fall within the main scope of 4MLD will now include:

- Persons trading in goods to the extent that payments are received in cash of €10K or more.

- Gambling services (not just casinos) – although Member States may choose to exempt non-casino providers following a risk assessment.

3. Strengthening the Risk Based Approach

This includes an obligation on the EU Commission to carry out an assessment of ML/TF risks affecting the internal market and cross border activities (first report due 26 June 2017).

4. Third Country Policy – “black list”

Rather than agree a list of ‘equivalent’ third countries, the Commission is to prepare a list of countries that are high risk from an AML/CTF perspective. Note that countries that appear on the “black list” are not automatically to be considered as having acceptable AML/CTF regimes.

5. Customer Due Diligence

4MLD will introduce:

- Tighter rules on simplified due diligence: the generous simplified due diligence CDD requirements for e-money products as set out in 3MLD are much more limited under 4MLD (see below).

- Enhanced due diligence: there will be an expansion to the scope of Politically Exposed Persons (PEPs).

6. Information on Beneficial Owners

Member States are to ensure that this information is held on central registers.

7. EMIs and PSPs – central points of contact

Where no branches are located in a Member State territory, EMIs and PSPs are to appoint a central point of contact (important for those relying on the e-commerce / services passport).

What are the key 4MLD customer due diligence changes for E-Money Issuers?

The current rules

Currently, E-Money issuers may be able to defer carrying out customer identification checks on their customers if they were considered low risk. These deferments were significant and allowed such checks to be delayed until certain caps were reached – notably that if an e-money device can be re-charged (such as typical with an e-money wallet product), then customer due diligence may not kick in until the customer has transacted €2,500 in a calendar year. This was a huge benefit to operators as it allowed them to acquire customers much more readily than traditional banking competitors. Please note, however, that not all Member States were so generous – Germany has always taken a hard line against e-money issuers in this regard and its influence has not gone unnoticed with the introduction of the new rules.

The 4MLD rules

The good days are over as far as the new rules are concerned. Under 4MLD, simplified due diligence and the potential deferment of customer ID checks for E-money issuers will only apply in much more limited circumstances. Most striking is that there is a new lower limit applied of just €250 – and this only applies if a set list of criteria is met. This includes that the payment instrument is used exclusively to purchase goods and services and further, that it cannot be funded by anonymous e-money.

The rules in detail

The following table gives you a direct comparison of the revised rules – please also note in particular the change to the withdrawal limits.

| 3MLD (current rules) | 4MLD (new rules) |

| Article 11(5)(d) | Article 12 |

| 5. By way of derogation from Articles 7(a), (b) and (d), 8 and 9(1), Member States may allow the institutions and persons covered by this Directive not to apply customer due diligence in respect of:… | 1. By way of derogation from points (a), (b) and (c) of the first subparagraph of Article 13(1) and Article 14, and based on an appropriate risk assessment which demonstrates a low risk, a Member State may allow obliged entities not to apply certain customer due diligence measures with respect to electronic money, where all of the following risk-mitigating conditions are met: |

| (d) electronic money, as defined in Article 1(3)(b) of Directive 2000/46/EC of the European Parliament and of the Council of 18 September 2000 on the taking up, pursuit of and prudential supervision of the business of electronic money institutions, | (a) the payment instrument is not reloadable, or has a maximum monthly payment transactions limit of EUR 250 which can be used only in that Member State; |

| where, if the device cannot be recharged, the maximum amount stored in the device is no more than EUR 150, | (b) the maximum amount stored electronically does not exceed EUR 250; |

| or where, if the device can be recharged, a limit of EUR 2 500 is imposed on the total amount transacted in a calendar year, | (c) the payment instrument is used exclusively to purchase goods or services; |

| except when an amount of EUR 1 000 or more is redeemed in that same calendar year by the bearer as referred to in Article 3 of Directive 2000/46/EC, | (d) the payment instrument cannot be funded with anonymous electronic money; |

| (e) the issuer carries out sufficient monitoring of the transactions or business relationship to enable the detection of unusual or suspicious transactions. | |

| For the purposes of point (b) of the first subparagraph, a Member State may increase the maximum amount to EUR 500 for payment instruments that can be used only in that Member State. | |

| 2. Member States shall ensure that the derogation provided for in paragraph 1 is not applicable in the case of redemption in cash or cash withdrawal of the monetary value of the electronic money where the amount redeemed exceeds EUR 100. |

What is the status of 4MLD?

The Directive was published in the EU Official Journal on 5 June 2015. On this basis we should expect the new rules to come into force on or before 26 June 2017.