(Note: the below is a high level review of certain potential issues and is not to be relied upon in any definitive manner nor as legal and/or regulatory advice).

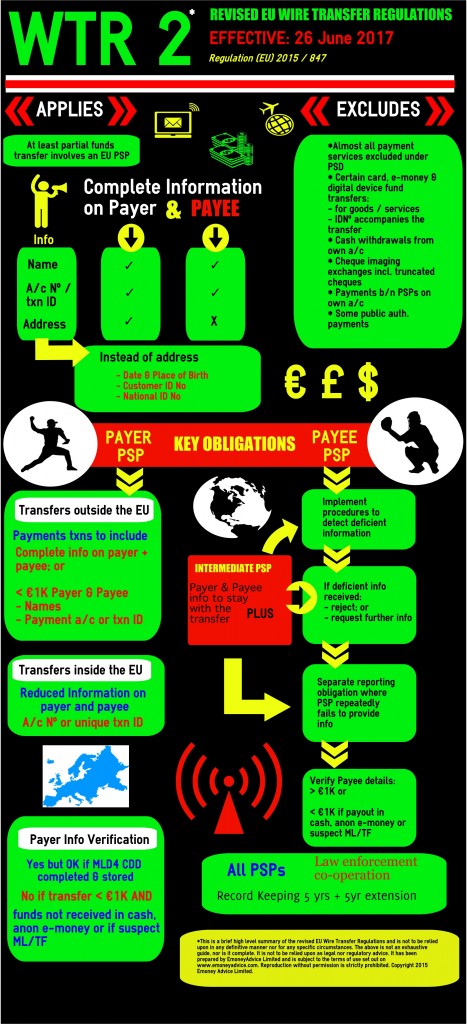

Together with a revised AML Directive (4MLD), the EU Parliament has also approved new Wire Transfer Regulations (WTR2) in the form of “The Regulation of the European Parliament and of the Council on information accompanying transfers of funds – repealing Regulation (EC) No 1781/2006”. These were published in the EU Official Journal on 5 June 2015 and will apply from 26 June 2017.

What is the background to Wire Transfer Regulations?

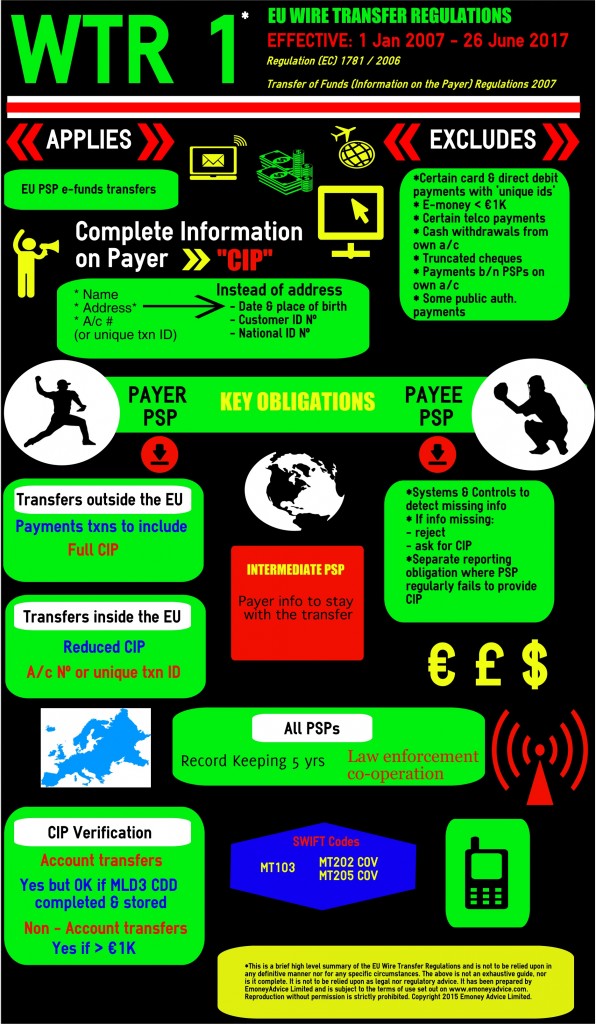

The existing Wire Transfer Regulations (Regulation (EC) No 1781/2006) were enacted as part of the EU’s anti-money laundering and counter terrorism measures and sit alongside the various other AML/CTF laws. The Wire Transfer regs require payment service providers (under certain circumstances) to ensure that electronic fund transfers include sufficient information on the person making the payment. These regulations came into force in 2007 as a direct consequence of the Financial Action Task Force’s (FATF) “Special Recommendation VII”.

Why new Wire Transfer regs?

WTR2 have been approved following a revision of EU AML/CTF laws, notably 4MLD. These come on the back of FATF’s revised set of principles published in 2012. WTR2 assists in the EU’s plan to combat AML/CTF and also to implement the new FATF recommendations. The Commission has stated that the new rules package:

go further in a number of fields to promote the highest standards for anti-money laundering and counter terrorism financing … and provide a more targeted and focussed risk-based approach.

What are some of the key differences between the Wire Transfer Regulations?

To understand some of the key differences between the regulations it is useful to note that WTR1 was introduced prior to PSD1. Moreover, WTR2 was developed in conjunction with MLD4 and acknowledges the role of the SEPA Migration Regulation and also the Regulation on Cross Border Payments in the Community.

WTR2 increases and changes the scope of which funds transfers are caught

Of particular interest are the changes which relate to P2P payments involving payment cards, e-money instruments and digital device payments.

Increasing obligations on Payer PSP

The information on both the payer AND the payee are to accompany the transfer of funds.

Payer PSPS – different verification requirements on Payer Info

Note in particular that under:

- WTR1: verification may not have been required if the payment related to a non-account transfer under €1,000 (although note that the JMLSG guidance notes that it should be undertaken for all amounts)

- WTR2: verification not necessarily required if the funds transfer is less than €1,000 – except if the funds are received in cash, anonymous electronic money or if there is a suspicion of money laundering / terrorist financing.

Payee PSP verification obligations

Note the obligations for:

- funds greater than €1,000 – the payee PSP is to verify the payee’s details before crediting / making the funds available

- funds less than €1,000 – the payee PSP is to verify the payee details if the payout will be in cash, anonymous e-money or if there is suspected money laundering or terrorist financing.

What is the impact of the new Wire Transfer regs on E-Money Issuers?

Similarly to the adoption of 4MLD, WTR2 will add compliance burden and restriction on the business activities of e-money issuers.

Under WTR1, there was a helpful and simple carve out for e-money issuers insofar that certain of the main obligations of WTR1 did not apply to them so long as the wire transfer did not exceed €1,000 – this was provided that the Member State in question had implemented the simplified due diligence requirements set out in the Anti-Money Laundering Directive.

Under WTR2, the rules for e-money issuers are not so simple – particularly those for e-money issuers that permit P2P funds transfers.

By way of high level summary:

- It is only e-money instruments which are used exclusively for the purchase of goods and services which fall outside scope – and only then if the identifying number of the instrument accompanies the transfer

- E-money P2P payments are expressly within scope

- The carve out to verify identity information for payments less than €1,ooo do not apply where funds have been received or paid out in anonymous electronic money

Details of the current and new rules are set out in the table below.

| WTR1 (current rules) | WTR2 (new rules) |

| Article 3(3) | Article 2(3) Scope |

| Where a Member State chooses to apply the derogation set out in Article 11(5)(d) of Directive 2005/60/EC, this Regulation shall not apply to transfers of funds using electronic money covered by that derogation, except where the amount transferred exceeds EUR 1 000. | This Regulation shall not apply to transfers of funds carried out using a payment card, an electronic money instrument or a mobile phone, or any other digital or IT prepaid or postpaid device with similar characteristics, where the following conditions are met: |

| (a) that card, instrument or device is used exclusively to pay for goods or services; and(b) the number of that card, instrument or device accompanies all transfers flowing from the transaction. | |

| However, this Regulation shall apply when a payment card, an electronic money instrument or a mobile phone, or any other digital or IT prepaid or post-paid device with similar characteristics, is used in order to effect a person-to-person transfer of funds. | |

| Article 5 (3) Transfer of Funds within the Union | |

| By way of derogation from Article 4(4), in the case of transfers of funds referred to in paragraph 2(b) of this Article, the payment service provider of the payer need not verify the information on the payer unless the payment service provider of the payer: | |

| (a) has received the funds to be transferred in cash or in anonymous electronic money; or | |

| (b) has reasonable grounds for suspecting money laundering or terrorist financing. | |

| Article 6(3) Transfer of funds outside of the Union | |

| By way of derogation from Article 4(4), the payment service provider of the payer need not verify the information on the payer referred to in this paragraph unless the payment service provider of the payer: | |

| (a) has received the funds to be transferred in cash or in anonymous electronic money; or | |

| (b) has reasonable grounds for suspecting money laundering or terrorist financing. | |

| Article 7(4) | |

| In the case of transfers of funds not exceeding EUR 1 000 that do not appear to be linked to other transfers of funds which, together with the transfer in question, exceed EUR 1 000, the payment service provider of the payee need not verify the accuracy of the information on the payee, unless the payment service provider of the payee: | |

| (a) effects the pay-out of the funds in cash or in anonymous electronic money; or | |

| (b) has reasonable grounds for suspecting money laundering or terrorist financing. |