The UK has implemented the 4MLD WTR2 just in time with the Money Laundering Regulation 2017 coming into force today.

While the JMLSG Guidance updates for 4MLD have been finalised they have not yet received Ministerial approval by the implementation date. Many firms would have been working off the draft (and now this version), however, reviews will need to be undertaken once the final text has been issued.

With many compliance teams preparing for PSD2 and GDPR, the delay of the JMLSG Guidance adds to the bottleneck of legislative implementation work to be carried out in the next 12 months.

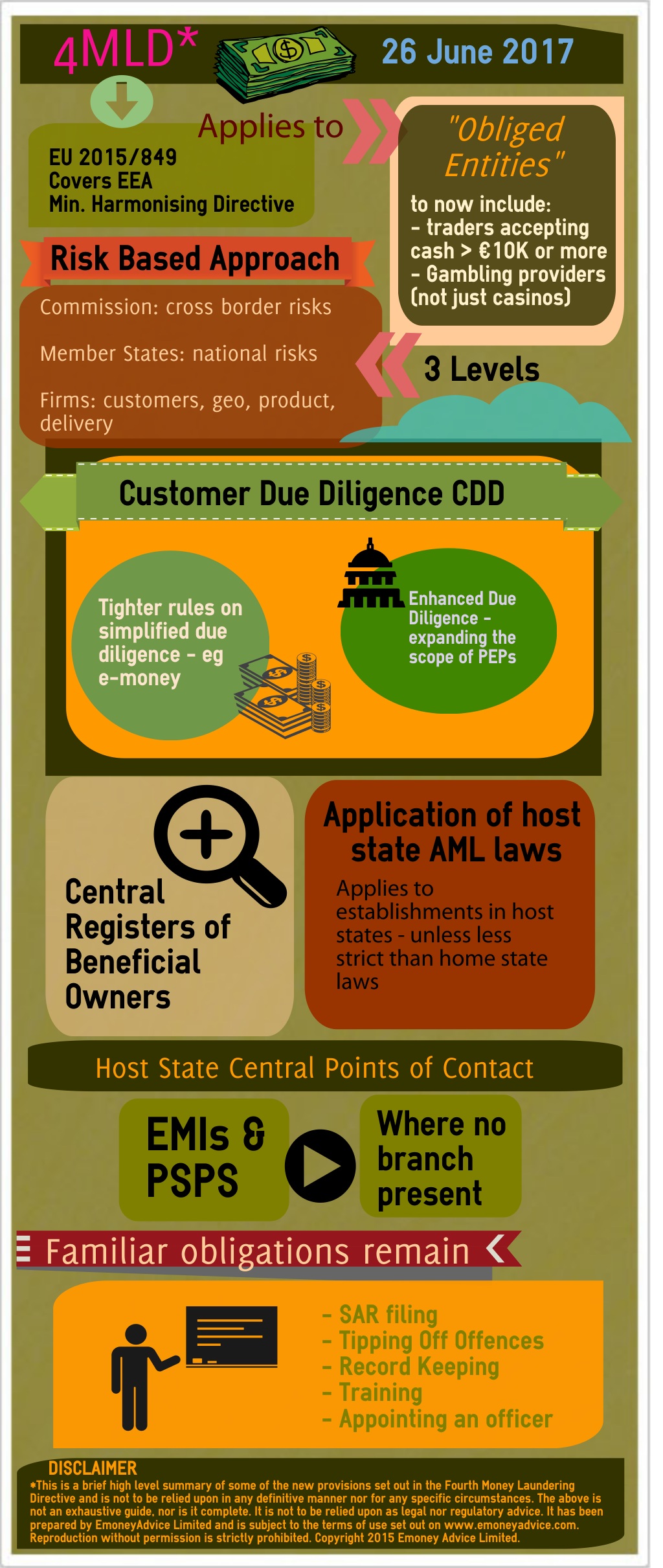

Here is a summary of what the current 4MLD WTR2 requires

Key 4MLD Changes

1. Tax crimes

Tax crimes have been expressly included in the list of predicate offences linked to the definition of “criminal activity”. It is envisaged that this will assist in better co-ordination between AML/CTF and tax authorities – including where cross border co-operation is required.

2. Obliged Entities

The types of persons which fall within the main scope of 4MLD will now include:

- Persons trading in goods to the extent that payments are received in cash of €10K or more.

- Gambling services (not just casinos) – although Member States may choose to exempt non-casino providers following a risk assessment.

3. Strengthening the Risk Based Approach

This includes an obligation on the EU Commission to carry out an assessment of ML/TF risks affecting the internal market and cross border activities (first report due 26 June 2017).

4. Third Country Policy – “black list”

Rather than agree a list of ‘equivalent’ third countries, the Commission is to prepare a list of countries that are high risk from an AML/CTF perspective. Note that countries that appear on the “black list” are not automatically to be considered as having acceptable AML/CTF regimes.

5. Customer Due Diligence

4MLD introduces:

- Tighter rules on simplified due diligence: the generous simplified due diligence CDD requirements for e-money products as set out in 3MLD are much more limited under 4MLD (see below).

- Enhanced due diligence: there will be an expansion to the scope of Politically Exposed Persons (PEPs).

6. Information on Beneficial Owners

Member States are to ensure that this information is held on central registers.

7. EMIs and PSPs – central points of contact

Where no branches are located in a Member State territory, EMIs and PSPs are to appoint a central point of contact (important for those relying on the e-commerce / services passport).

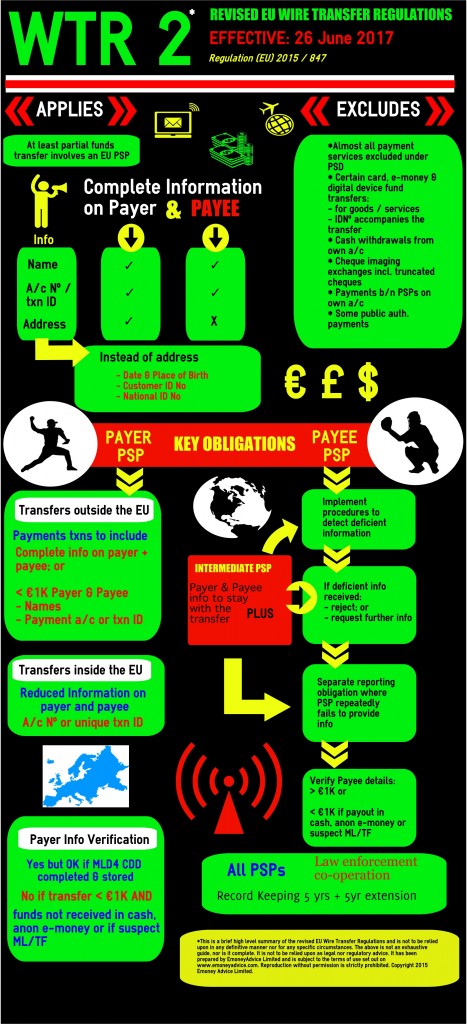

What about the new WTR2?

WTR2 increases and changes the scope of which funds transfers are caught

Of particular interest are the changes which relate to P2P payments involving payment cards, e-money instruments and digital device payments.

Increasing obligations on Payer PSP

The information on both the payer AND the payee are to accompany the transfer of funds.

Payer PSPS – different verification requirements on Payer Info

Note in particular that under:

- WTR1: verification may not have been required if the payment related to a non-account transfer under €1,000 (although note that the JMLSG guidance notes that it should be undertaken for all amounts)

- WTR2: verification not necessarily required if the funds transfer is less than €1,000 – except if the funds are received in cash, anonymous electronic money or if there is a suspicion of money laundering / terrorist financing.

Payee PSP verification obligations

Note the obligations for:

- funds greater than €1,000 – the payee PSP is to verify the payee’s details before crediting / making the funds available

- funds less than €1,000 – the payee PSP is to verify the payee details if the payout will be in cash, anonymous e-money or if there is suspected money laundering or terrorist financing.